Health insurance is an essential investment, especially for families. It provides financial protection against unexpected medical expenses and ensures access to quality healthcare. In 2025, the health insurance landscape is evolving with new features and benefits tailored for families. Here’s what you need to know:

1. Importance of Family Health Insurance

Family health insurance plans cover all members under a single policy, making them more convenient and cost-effective than individual plans. These policies typically offer comprehensive coverage for hospitalization, outpatient care, preventive check-ups, and more. With rising healthcare costs, having a family health plan is vital for financial security.

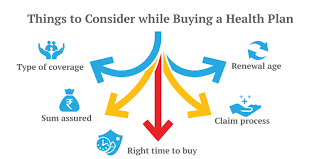

2. Key Features to Look For

When choosing a family health insurance plan, consider the following features:

- Coverage Limits: Ensure the sum insured is adequate for the entire family.

- Cashless Hospitalization: Check if the insurer has a wide network of hospitals offering cashless services.

- Pre- and Post-Hospitalization Benefits: Look for coverage of expenses incurred before and after hospitalization.

- Maternity and Newborn Coverage: Plans with maternity benefits are ideal for growing families.

- No-Claim Bonus: Opt for plans that reward you with increased coverage for claim-free years.

3. Types of Health Insurance Plans

Several types of family health insurance plans are available in 2025:

- Floater Plans: These cover all family members under a single sum insured. For example, a policy with a $20,000 sum insured can be used by any family member up to that limit.

- Individual Plans: Separate policies for each family member, offering higher coverage but at a higher cost.

- Critical Illness Plans: These provide lump-sum payouts for serious conditions like cancer or heart disease.

- Top-Up Plans: These extend the coverage of your base plan once the deductible is exceeded.

4. Digital Health Insurance Services

In 2025, digitalization has made health insurance more accessible. You can now:

- Compare policies online to find the best fit for your family.

- Use apps to manage policies, file claims, and track expenses.

- Access telemedicine services for consultations with healthcare providers.

5. Premium Calculation

Health insurance premiums depend on various factors, including the number of family members, their ages, medical history, and the coverage amount. Some tips to reduce premiums include:

- Choosing higher deductibles.

- Opting for family floater plans instead of individual policies.

- Maintaining a healthy lifestyle to avoid higher premiums due to pre-existing conditions.

6. Government and Employer-Sponsored Plans

Governments and employers often provide group health insurance plans for families. These plans are affordable but may have limited coverage. It’s advisable to evaluate these policies and consider additional individual or family plans to fill coverage gaps.

7. Riders and Add-Ons

Enhance your family’s health insurance with riders and add-ons:

- Accident Cover: Additional protection for injuries caused by accidents.

- Critical Illness Rider: Covers major illnesses not included in standard policies.

- Hospital Daily Cash: Provides a daily allowance during hospitalization.

8. Future Trends in Family Health Insurance

The health insurance industry in 2025 is embracing innovation:

- AI-Powered Customization: Policies tailored to individual health profiles.

- Wearable Integration: Discounts and rewards for using health-monitoring devices.

- Preventive Health Benefits: Coverage for fitness programs, mental health services, and wellness apps.

9. How to Choose the Right Plan

Follow these steps to select the best family health insurance plan:

- Assess your family’s healthcare needs.

- Compare multiple policies for coverage, exclusions, and premiums.

- Read customer reviews and understand claim settlement ratios.

- Consult an insurance advisor if needed.

10. Common Mistakes to Avoid

- Ignoring policy exclusions and waiting periods.

- Opting for the cheapest plan without evaluating coverage.

- Not disclosing pre-existing conditions, which can lead to claim rejections.

- Delaying the purchase of insurance until health issues arise.

Conclusion

Family health insurance is a cornerstone of financial and physical well-being. By understanding the features, benefits, and trends in 2025, you can choose the right plan that ensures comprehensive healthcare for your loved ones. Start comparing policies today to secure your family’s future.